saybook.ru Overview

Overview

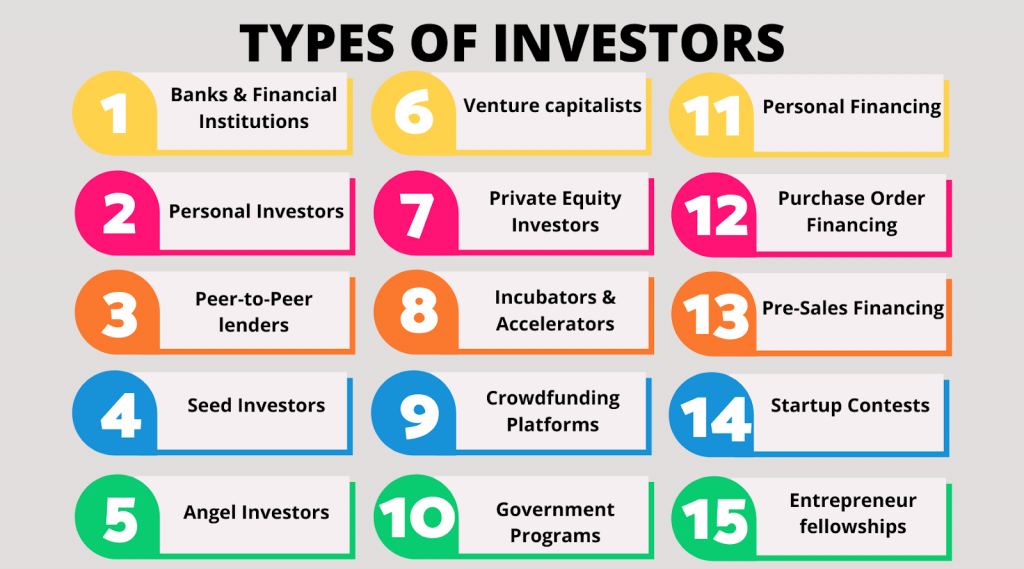

Who Is An Investor

In financial regulatory schemes, the term "investor" generally falls under two bucket categories–the "retail investor" and the "institutional investor." Retail. Whether you're new to investing or already investing, NASAA and its members provide a variety of online investor education resources for investors of all ages. Investors commit their own money or their client's money into products, property, or financial ventures in order to gain more money in return. Qualified purchasers typically have broader investment opportunities then accredited investors. After all, if an investor meets the $5M investment threshold for. Define Financial Investor. means any investor or series of Affiliated investors whose primary business is the investment of capital for financial gain. investor? Answer: First, you need to submit a request in the system to obtain professional investor status. Based on this request, we will assess your. An investor is an individual, company or fund that buys securities or other assets with the expectation of profiting from the change in the value of those. An Investor is a professional who invests money or part of their money in a particular account, business, or another financial asset for long-term financial. Who are Investors? An investor in business is typically an individual or entity that allocates capital with the expectation of generating a return on their. In financial regulatory schemes, the term "investor" generally falls under two bucket categories–the "retail investor" and the "institutional investor." Retail. Whether you're new to investing or already investing, NASAA and its members provide a variety of online investor education resources for investors of all ages. Investors commit their own money or their client's money into products, property, or financial ventures in order to gain more money in return. Qualified purchasers typically have broader investment opportunities then accredited investors. After all, if an investor meets the $5M investment threshold for. Define Financial Investor. means any investor or series of Affiliated investors whose primary business is the investment of capital for financial gain. investor? Answer: First, you need to submit a request in the system to obtain professional investor status. Based on this request, we will assess your. An investor is an individual, company or fund that buys securities or other assets with the expectation of profiting from the change in the value of those. An Investor is a professional who invests money or part of their money in a particular account, business, or another financial asset for long-term financial. Who are Investors? An investor in business is typically an individual or entity that allocates capital with the expectation of generating a return on their.

15 percent of all current US stock market investors say they first began investing in , according to a new Schwab survey. Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. Most REITs trade on major stock exchanges, and they offer a number of benefits to investors. Getting a commitment from a private investor relies on the strength of a founder's pitch. But the pitch process starts long before a founder finds themselves. An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). US Global Investors, Inc. is an innovative investment manager with vast experience in global markets and specialized sectors. A helpful guide to learning more about investing. Page 2. An overwhelming 97 percent of investors realize they need to be better informed. A solid business plan demonstrates to investors that you're serious about your business and that you've given thought to your plans to make money. Both investors and creditors play crucial roles in the economic growth and stability of companies and markets. However, their objectives, risks, and rewards. Most investors purchase with all cash, you can sell your property as soon as your two parties agree on the conditions of sale. An investor is someone who provides (or invests) money or resources for an enterprise, such as a corporation, with the expectation of financial or other. investor behaviour is key towards curbing their impact on your portfolio. Here we explore five common investor biases and how they affect investors. investor? Answer: First, you need to submit a request in the system to obtain professional investor status. Based on this request, we will assess your. A forum for investor members seeking to engage companies on sustainability issues through proxy resolutions. Ceres tracks shareholder proposals and provides. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money should be rewarded for their risk. You. The limit of coverage and whether it is applied on a per-account or per-investor basis should be specified. If the coverage is per account, then it is necessary. In this guide we'll run you through some of those key investor rights that Seedrs requires and what these mean in practice for you. The PRI, a UN-supported network of investors, works to promote sustainable investment through the incorporation of environmental, social and governance. Active Trading is a specific type of investment management that involves shorter holding periods for individual investments. At Vanguard you're more than just an investor, you're an owner. Vanguard isn't owned by shareholders. It's owned by the people who invest in our funds.1 Our.

How Can I Invest In Samsung

Experts believe that Samsung Electronics is a mammoth company with a strong brand name and a large diversified business. Samsung SDI Co., Ltd. specializes in developing Lithium Ion Battery (LIB) technology. The Company also manufactures cathode ray tubes (CRTs) for televisions. Invest commission-free. Buy and sell fractional shares for as little as £1. Overview · Historical data. Samsung Venture Investment unearths outstanding venture businesses and pursues coexistence between investors and venture businesses. Samsung Catalyst Fund | followers on LinkedIn. Samsung Electronics' evergreen multi-stage venture capital fund | Samsung Catalyst Fund is Samsung. We focus broadly on these technology areas, but invest opportunistically in founders pursuing the imagined and impossible. Artificial Intelligence & Intelligent. 1. Open A Brokerage Account · 2. Make Your Research on Samsung Electronics Co., Ltd. Stock · 3. Determine How Much You Want to Invest and Your Risk Tolerance · 4. Not sure where to start when it comes to Investing? Learn how to invest your money with eToro, the world's leading social investment network, at Samsung KX. investing in future-oriented businesses based on new and innovative technologies that are expected serve as new growth engines. Samsung Venture Investment. Experts believe that Samsung Electronics is a mammoth company with a strong brand name and a large diversified business. Samsung SDI Co., Ltd. specializes in developing Lithium Ion Battery (LIB) technology. The Company also manufactures cathode ray tubes (CRTs) for televisions. Invest commission-free. Buy and sell fractional shares for as little as £1. Overview · Historical data. Samsung Venture Investment unearths outstanding venture businesses and pursues coexistence between investors and venture businesses. Samsung Catalyst Fund | followers on LinkedIn. Samsung Electronics' evergreen multi-stage venture capital fund | Samsung Catalyst Fund is Samsung. We focus broadly on these technology areas, but invest opportunistically in founders pursuing the imagined and impossible. Artificial Intelligence & Intelligent. 1. Open A Brokerage Account · 2. Make Your Research on Samsung Electronics Co., Ltd. Stock · 3. Determine How Much You Want to Invest and Your Risk Tolerance · 4. Not sure where to start when it comes to Investing? Learn how to invest your money with eToro, the world's leading social investment network, at Samsung KX. investing in future-oriented businesses based on new and innovative technologies that are expected serve as new growth engines. Samsung Venture Investment.

stock has fallen by −% compared to the previous week, the month change is a −% fall, over the last year SAMSUNG ELECTRONICS has showed a −%. Get Samsung Electronics Co Ltd (SSNLF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. The information contained in this website has been prepared to assist potential investors in making an informed decision in relation to investing in the ETFs /. SAMSUNG ELECTRO-MECHANICS · PRODUCTS · Passive Component · Module · Substrate · Application · SUPPORT · Contact Us · Buy Now · Sales Representatives · Technical. How to buy shares in Samsung ; Open a brokerage account. Choose from our top broker picks or compare brokers in depth. Then, complete an application. ; Fund your. Complete Samsung Electronics Co. Ltd. stock information by Barron's. View Maj Invest Value Aktier, K, %, K, %, Feb 28, Copyright. How to Invest · Virtual Stock Exchange · Video · MarketWatch 25 Years · SectorWatch Samsung Electronics Co. Ltd. Watchlist. Create an email alert. You must. View share price quotes, updates and the latest stock news for Samsung Electronics CO LTD (Att) (LSE:SMSN) Invest with AJ Bell; Open an account. The ETF with the largest weighting of Samsung Electronics Co., Ltd. is the HSBC MSCI Korea Capped UCITS ETF USD. ETF, Weight, Investment focus, Holdings, TER. Offering a customized consulting for investing in stocks, bonds, OTC as well as alternative products. How to Buy Stock. ESG. Board of Directors · Board Committees · Sustainability · Articles of Incorporation · Global Code of Conduct. Resources. IR FAQs · Contact. So, investing in shares of big companies, as you mentioned like Samsung, Apple, and others, the products whom we use daily, can bring great. | Complete Samsung Electronics Co. Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. stock trading and investing Stocks sink but TSMC, Samsung bullish on AI at major trade show. Reuters. The Company paid out approximately KRW trillion in regular dividends each year. M&A investments were not deducted from FCF, the source of our shareholder. Samsung NEXT invests in transformative seed-stage software and services startups. Mountain View, California, United States. Find the latest Samsung SDI Co., Ltd. (KS) stock quote, history, news and other vital information to help you with your stock trading and investing. Stock Information. Stock Chart · Shareholder Return · Listing Information · Shareholder Structure · How to Buy Stock. open close. ESG. Board of Directors. See the latest Samsung Electronics Co Ltd stock price (XKRX), related news, valuation, dividends and more to help you make your investing decisions.

Home Insurance Premiums Going Up

Homeowners insurance costs increased by nearly 11% between 20according to private banking firm S&P Global, joining the list of necessary. If we increase rates it may be because repair and replacement costs have gone up, and we have to make sure we can cover future claims. We never raise rates to. Why homeowner premiums are going up. Insurance premiums go up when the costs involved in repairing or replacing your home go up. Repairs are more expensive. We recognize that any increase to your premium is disappointing. Sometimes, even if you haven't had an accident or filed a claim, your insurance premiums. premium shall be charged from the effective date of coverage. If you do not accept the increase in the premium, you may ask the company to cancel the policy. Drive safely: Nothing affects your auto insurance rates more than your driving record. · Shop around: Consumers can increase their odds of getting the best. Homeowners insurance rates can go up for a variety of reasons, including rising rebuilding costs, a higher price tag on materials or labor, your home has. Increased insurance premiums could be a result from an increase in claims from weather events linked to climate changes, the replacement cost of your home may. Climate change, natural disasters, and insurance costs Climate change is bringing more frequent—and more powerful—storms. Even without the pandemic and the. Homeowners insurance costs increased by nearly 11% between 20according to private banking firm S&P Global, joining the list of necessary. If we increase rates it may be because repair and replacement costs have gone up, and we have to make sure we can cover future claims. We never raise rates to. Why homeowner premiums are going up. Insurance premiums go up when the costs involved in repairing or replacing your home go up. Repairs are more expensive. We recognize that any increase to your premium is disappointing. Sometimes, even if you haven't had an accident or filed a claim, your insurance premiums. premium shall be charged from the effective date of coverage. If you do not accept the increase in the premium, you may ask the company to cancel the policy. Drive safely: Nothing affects your auto insurance rates more than your driving record. · Shop around: Consumers can increase their odds of getting the best. Homeowners insurance rates can go up for a variety of reasons, including rising rebuilding costs, a higher price tag on materials or labor, your home has. Increased insurance premiums could be a result from an increase in claims from weather events linked to climate changes, the replacement cost of your home may. Climate change, natural disasters, and insurance costs Climate change is bringing more frequent—and more powerful—storms. Even without the pandemic and the.

The premiums charged for homeowners and tenants insurance vary widely from company to company. A company may not terminate a policy or increase a renewal. Here's why: Insurers may raise premiums to attempt to offset the rising costs of claims. [2] “Does Filing a Home Insurance Claim Raise Your Rates?” Karen. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded. Let's look at reasons why your car insurance premium may increase over the years. These may include having filed a new claim or having had a traffic violation. Your rate could go up because of construction costs, building code changes or home improvements that could increase your rebuild cost. It's important to make. Senate Bill includes provisions to increase the accountability and the Office of Insurance Regulation's (OIR) oversight of insurance companies in Florida. A new rule requires all insurance companies to tell their policyholders the reasons behind a premium increase. The new regulation applies to auto and. Increase your deductible on your policy. The deductible is the part of the loss you must pay when you make a claim. When the deductible goes up, the premium. Swimming pools usually raise the cost of your coverage because they increase your liability exposure. Trampolines, while fun, are injuries waiting to happen. My yearly home insurance went up 83% with Farmers from to Based out of southern CA. The representative mentioned that it increased. Filing a claim increases your risk in the eyes of your insurance provider, and as your risk goes up, so do your premiums. You can expect to see a rate increase. Increase your deductible on your policy. The deductible is the part of the loss you must pay when you make a claim. When the deductible goes up, the premium. For instance, adding a new room, new insulation, and inflation all increase the replacement cost of your home, while the actual cash value of the home may. Driving violations, accidents, and claims can cause your rate to go up · Factors outside of your control like claim costs in your area can also increase your. Homeowners insurance costs increased by nearly 11% between 20according to private banking firm S&P Global, joining the list of necessary. The price range is due to multiple factors that affect homeowners insurance rates, including location, claims history, coverage limits, and your home's. their auto insurance rates increase at every renewal, even if This applies when you pair your auto insurance along with your home or renters policy. Some companies that sell homeowners, auto and liability coverage will take 5 to 15 percent off your premium if you buy two or more policies from them. But make. Insurance premiums go up when costs to repair or replace vehicles go up. As more technology is integrated into vehicles, repairs become more expensive and time.

What Size Carry On Can You Bring On A Plane

:max_bytes(150000):strip_icc()/liquids-on-a-plane-4046937-FINAL-5ba3d35d4cedfd002506643d.png)

Size restrictions. Overhead bin: Including wheels and handles, carry-on bags must not exceed 22" L ( cm) x 14" W . Depending on the fare purchased, you can bring up to two free carry-on articles onboard, including a personal item and a standard carry-on bag. Free Items to Carry On · Limit liquids, gels, aerosols and pastes items to a maximum of ounces or milliliters · Place all items in one single quart-size. Carry-on baggage allowance can vary according to the airline, the cabin class you are traveling in and even the size of the aircraft. As a general guide, carry-. The total can be up to cm ( inches). Note: If you are flying on our smaller Q aircrafts, the measurement 'C' must not exceed 22cm ( inches). You can bring one carry-on bag and one personal item for free on most flights. Most airlines will allow you to check one bag and have one carry-on bag. There is normally a maximum weight limit of 50 pounds per checked bag as well as a. One cabin bag that has dimensions of no more than 23 x 40 x 55 cm (9 x x inches), plus one personal item with maximum dimensions of 16 x 33 x 43 cm (6. Although no weight limit applies to carry-on baggage, your bag must be light enough that you can store it in the overhead bin unassisted. * If you're. Size restrictions. Overhead bin: Including wheels and handles, carry-on bags must not exceed 22" L ( cm) x 14" W . Depending on the fare purchased, you can bring up to two free carry-on articles onboard, including a personal item and a standard carry-on bag. Free Items to Carry On · Limit liquids, gels, aerosols and pastes items to a maximum of ounces or milliliters · Place all items in one single quart-size. Carry-on baggage allowance can vary according to the airline, the cabin class you are traveling in and even the size of the aircraft. As a general guide, carry-. The total can be up to cm ( inches). Note: If you are flying on our smaller Q aircrafts, the measurement 'C' must not exceed 22cm ( inches). You can bring one carry-on bag and one personal item for free on most flights. Most airlines will allow you to check one bag and have one carry-on bag. There is normally a maximum weight limit of 50 pounds per checked bag as well as a. One cabin bag that has dimensions of no more than 23 x 40 x 55 cm (9 x x inches), plus one personal item with maximum dimensions of 16 x 33 x 43 cm (6. Although no weight limit applies to carry-on baggage, your bag must be light enough that you can store it in the overhead bin unassisted. * If you're.

Weight and Size. Carry-on baggage allowance can vary according to the airline, the cabin class you are traveling in and even the size of the aircraft. As a. Measurements should include the wheels and handles. Whilst there is no weight limit on carry-on items, they must be light enough that you can stow them in the. Hand baggage is included as part of all our tickets. The size of your bag needs to be a maximum of 23 x 36 x 56cm (that's around 9 x 14 x 22 inches). For customers boarding in India, you are allowed one piece of carry‑on baggage. The size of the carry‑on baggage may not exceed centimeters (length + width. You are allowed to bring a quart-sized bag of liquids, aerosols, gels, creams and pastes in your carry-on bag and through the checkpoint. Before you pack, make sure your bags meet our checked bag size dimensions and weight requirements. Checked bags exceeding 62" ( cm) in overall dimensions. When you're flying Wizz Air, you are allowed to bring one carry-on item measuring up to 40 cm x 30 cm x 20 cm. Maximum Hand Luggage Weight. Depending on the. What is Air Canada's (AC) carry-on baggage policy? · 46 linear inches ( x x 9 in) or centimeters (55 x 40 x 23 cm) including handles and wheels. If you are travelling in tourist class, you are allowed one carry-on bag of up to 10 kg for free. If flying in Business, you can carry two bags of up to 14 kg. 45 linear inches (22 x 14 x 9 in) or centimeters (56 x 36 x 23 cm) including handles and wheels. Fit in the overhead bin or under the seat in front of you. You'll still be allowed one carry-on bag and one personal item such as a purse, briefcase, or laptop bag. To help make the boarding process as smooth as. For items you wish to carry on, you should check with the airline to ensure that the item will fit in the overhead bin or underneath the seat of the airplane. Most carry-ons sold today measure 22" x 14" x 9" inches. As a general rule, US airlines permit luggage that measures a total of 45 linear inches ( Verify the specifics for your airline - and for your ticket type, as some economy fares have stricter guidelines - when you're booking your flight. In general. On average, a carry-on luggage size limit of 22” x 14” x 9” is safe on most airlines. This applies to airlines like Allegiant Air, Alaska, Delta Airlines. Baggage allowance for carry-on and checked baggage · Overweight baggage. A checked bag can weigh up to 23 kg. · Oversized baggage. A checked bag can be up to You can pay for one additional carry-on bag with maximum dimensions of 56x45x25 cm/ 22x18x10 in (12 kg/26 lb) including handles and wheels. Most travelers can bring on board one full-size carry-on bag and one personal item (handbag, umbrella, camera, etc.). If your itinerary includes a flight by. Some airlines, like Qatar Airways, even have stricter limits, allowing a maximum carry-on length of just 20 inches. So, before you pack, always check the carry-. not to exceed 9L x 14W x 22H or 45 linear inches ( cm) (length + width + height);; limited to 25 pounds (11 kg). NOTE: We reserve the right to stow any carry.

Epilator With Facial Attachment

Braun manufactures hair removal and hair care products, including dryers, straighteners, shavers, trimmers and epilators for men and women. Braun manufactures a. The FacePro can either be used as an epilator for those small areas around the face or as a toner with the metal attachment. The soft brush glides over your. The ES-EL7A-P epilator and shaver for Women Provides easy, full-body hair removal at home. It uses five different attachments to epilate, shave and trim. face or if they have attachment heads that can be used on those areas. Most epilators that are designed for the face are small and contain batteries. iluminage/Me Smooth Epilator Cartridge Head is an accessory attachment that is used with the iluminage Touch, Me Smooth, and me Soft hair removal devices. Where can I use an epilator? Epilating Face; Epilating Legs; Epilating Bikini Area; Epilating attachment, cap for epilating facial hair, or a built-in light. Braun makes reliable epilators too! Their kits provide accessories and different heads depending where you need to use it on. Upvote 2. Panasonic Epilator & Shaver System, ES-EL7A, W/Attachment Womens Shaver, Wet/Dry. $ Trending at $ The Braun Face Spa Pro is the World's 1st 2-in-1 facial epilation and cleansing device. Gently remove facial hair by the root with the epilator attachment for. Braun manufactures hair removal and hair care products, including dryers, straighteners, shavers, trimmers and epilators for men and women. Braun manufactures a. The FacePro can either be used as an epilator for those small areas around the face or as a toner with the metal attachment. The soft brush glides over your. The ES-EL7A-P epilator and shaver for Women Provides easy, full-body hair removal at home. It uses five different attachments to epilate, shave and trim. face or if they have attachment heads that can be used on those areas. Most epilators that are designed for the face are small and contain batteries. iluminage/Me Smooth Epilator Cartridge Head is an accessory attachment that is used with the iluminage Touch, Me Smooth, and me Soft hair removal devices. Where can I use an epilator? Epilating Face; Epilating Legs; Epilating Bikini Area; Epilating attachment, cap for epilating facial hair, or a built-in light. Braun makes reliable epilators too! Their kits provide accessories and different heads depending where you need to use it on. Upvote 2. Panasonic Epilator & Shaver System, ES-EL7A, W/Attachment Womens Shaver, Wet/Dry. $ Trending at $ The Braun Face Spa Pro is the World's 1st 2-in-1 facial epilation and cleansing device. Gently remove facial hair by the root with the epilator attachment for.

The Lumilisse by Conair hair removal device includes two attachments to ensure perfectly smooth results all over. Achieve salon smooth skin with this Braun. Features a shaver & trimmer attachment for hair removing in delicate areas. 3x Facial brush attachments to cleanse and exfoliate. Cordless use as much as How to choose the best epilator for facial hair. While not all epilators are various attachments; built-in lighting; whether they work dry or wet. The FacePro can either be used as an epilator for those small areas around the face or as a toner with the metal attachment. The soft brush glides over your. Have salon beauty treatments at home with FaceSpa Pro , the ultimate 3-in-1 epilator system with an epilator, skin cleansing brush, and toning devices. E60 2-In-1 Purple Epilator, Shaver/Trimmer & Sensitive Attachment (APEPY) Dual opposed heads stretch the skin to make the process extra gentle and. How to choose the best epilator for facial hair. While not all epilators are various attachments; built-in lighting; whether they work dry or wet. Braun Face 2in1 Epilator for Women with Cleansing Brush attachment & 2 extras Braun Face. World's first facial epilator & cleansing brush system. Treat. Braun Face epilator with facial cleaning brush attachment. A light tug on the epilator head is all that is required to remove it from the handle. With the. An epilator device is one solution for facial hair removal Epilators such as Braun epilators come with many attachments, so you can use an attachment that. Deluxe hair removal beauty set for face & body. · 3x body exfoliation & massage attachments tone & remove dead skin, to prevent ingrown hairs. · Epilator removes. Rifle Paper Co. + Venus Braun FaceSpa Pro FE 2-in-1 Facial Epilator & Cleansing Brush System. Home / Uncategorized / Epitome 5-in-1 Hair Removal Epilator with Facial Cleanser and Shaver attachments Wet/Dry with Built-in Light. Sale! Philips Lumea epilator face attachment For models: BRI/00, BRI/00, BRI/ Goods for personal use. Is not refundable. Original epilation attachment. Facial epilation cap; Smooth skin for up to 4 weeks; Automatic universal Shaving head attachment. List Price: $ Price: $ Details. Philips. To me, the Eversoft looks just like my first Braun Silk-epil except that it is wider and has more 'pluckers' and, of course, it has the bumpy roller attachment. separate attachment for facial hair is included, for use below the cheekbones. Over time, with continued IPL use, more hair will be treated. Lumilisse has 2. Epilator for Women, Includes Shaver and Facial Cleansing Exfoliator Brush Attachments, Waterproof, Cordless and Rechargeable - United States ; Estimated Sep 5 -. Log in · Micro-Pedi · Micro-Nail · Epilators · Refills · Accessories · Support. Emjoi® Emagine Epilator. The world's most powerful epilator with 72 tweezers. Premium Facial epilator 15 cm with 3 blades and attachment 5 el. by Zwilling - With the premium facial epilator by Zwilling, removing unwanted hair from the.

Should I Open A Cd Account

A CD will usually pay a higher rate than a high yield savings account, so a higher yield is usually better. That said, a CD does not change. Retirement — CDs are ideal for retirement savings because they give you a guaranteed rate of return on your money, so you know exactly what you're getting and. Unlike traditional or high-yield savings accounts, which have variable APYs, most CDs lock your money into a fixed interest rate the day you open the account. With a CD, the interest rate will not change after you open the CD account until the term of the CD has ended. CDs, like savings and money market accounts, are. A CD bought through a federally insured bank is insured up to $, The $, insurance covers all accounts in your name at the same bank, not each CD or. A CD is a way to put away money beyond what you've accumulated in your savings account, without taking on much more market risk. CDs can be a safe, secure way to set aside money for your financial goals. · A CD may offer a higher interest rate and APY than a high-yield savings account or. A certificate of deposit is a relatively low-risk investment, typically offering higher interest rates than the usual savings account. For a new CD, you'll make. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a. A CD will usually pay a higher rate than a high yield savings account, so a higher yield is usually better. That said, a CD does not change. Retirement — CDs are ideal for retirement savings because they give you a guaranteed rate of return on your money, so you know exactly what you're getting and. Unlike traditional or high-yield savings accounts, which have variable APYs, most CDs lock your money into a fixed interest rate the day you open the account. With a CD, the interest rate will not change after you open the CD account until the term of the CD has ended. CDs, like savings and money market accounts, are. A CD bought through a federally insured bank is insured up to $, The $, insurance covers all accounts in your name at the same bank, not each CD or. A CD is a way to put away money beyond what you've accumulated in your savings account, without taking on much more market risk. CDs can be a safe, secure way to set aside money for your financial goals. · A CD may offer a higher interest rate and APY than a high-yield savings account or. A certificate of deposit is a relatively low-risk investment, typically offering higher interest rates than the usual savings account. For a new CD, you'll make. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a.

Because your money is locked away for a fixed time, CD accounts aren't good options for cash you may need quick access to, like money in an emergency fund. What. Though money market accounts usually have lower interest rates than CDs, they enable owners to access funds as needed. They generally require larger minimum. When it comes to getting the most from a personal CD account, you should always try to invest the most that you can and for. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. CDs can be a safe, secure way to set aside money for your financial goals. · A CD may offer a higher interest rate and APY than a high-yield savings account or. Use this CD calculator to compare certificate of deposit accounts and see how much you could earn over each CD term we offer. If you're planning to save your money long term, CDs offer more attractive rates than traditional savings accounts. FDIC-Insured Savings. Certificates of. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. They exhibit zero volatility, offer guaranteed interest and, if structured properly, are fully insured up to $, for individual accounts. The Federal. Save for the short-term or the long run with terms that range from three months to five years. Open a CD account with $ or more, and choose from Regular, IRA. CD accounts can offer a predictable rate of return for your money and are far less risky compared to other investments. You could even open multiple CD accounts. A savings account can stay open as long as you want; it doesn't have a fixed term like a CD. You can deposit and withdraw money on your schedule with no. When you open a CD, you decide exactly how much you want to invest and how long to invest. Many banks allow you to open a CD account online. In exchange for. Bank Certificates of Deposit (CDs) are savings accounts with a fixed interest rate and term. When you deposit money in a bank for a specified period, the bank. Open account. 3 great reasons why you should open a CD account. More for your money. CDs offer our most competitive, promotional rates - and great returns. Yes, CDs are generally considered safe. You're guaranteed to receive the initial deposit back on top of any interest you've earned; as long as you follow terms. They are steady and predictable; offer FDIC insurance1 and a broad selection of terms (maturity dates), and can also be held in a variety of investment accounts. With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. However, CDs generally allow your savings to grow at a faster rate than they would in a savings account. How CDs work. In exchange for depositing your money. Should I open a CD? If you have some savings and a goal in the not-so-distant future, a CD can help your money earn more without too much risk. Banks offer.

What Is Money Market Investment

A money market fund is a type of fixed income mutual fund that invests in debt securities characterized by their short maturities and minimal credit risk. Money Market mutual funds are short-term debt funds. They invest in various money market instruments and endeavour to offer good returns over a period of up to. A money market (or cash equivalent) fund is a type of mutual fund that makes short-term investments in a range of highly liquid, low-risk debt securities. Money market funds invest in instruments that have a maturity of 1 year. Compare our in-house ET Money ranks of all Money market funds in India and start. Keep your money accessible with low-risk money market funds · -- -- · Lower · · · · Since 4/08/ · Money market funds are mutual funds that invest in instruments such as cash, cash-equivalent securities, and debt securities with a high credit rating and. Key Takeaways · The money market involves the purchase and sale of large volumes of very short-term debt products such as overnight reserves or commercial paper. Money market funds are investments in short-term debt securities. When you think about where to keep your hard-earned cash, checking and savings. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A money market fund is a type of fixed income mutual fund that invests in debt securities characterized by their short maturities and minimal credit risk. Money Market mutual funds are short-term debt funds. They invest in various money market instruments and endeavour to offer good returns over a period of up to. A money market (or cash equivalent) fund is a type of mutual fund that makes short-term investments in a range of highly liquid, low-risk debt securities. Money market funds invest in instruments that have a maturity of 1 year. Compare our in-house ET Money ranks of all Money market funds in India and start. Keep your money accessible with low-risk money market funds · -- -- · Lower · · · · Since 4/08/ · Money market funds are mutual funds that invest in instruments such as cash, cash-equivalent securities, and debt securities with a high credit rating and. Key Takeaways · The money market involves the purchase and sale of large volumes of very short-term debt products such as overnight reserves or commercial paper. Money market funds are investments in short-term debt securities. When you think about where to keep your hard-earned cash, checking and savings. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds.

A money market fund (also called a money market mutual fund) is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills. The most familiar money market instruments are bank deposits, which are not considered securities, even though certificates of deposit are sometimes traded like. Money market securities are essentially IOUs issued by governments, financial institutions, and large corporations. These instruments are very liquid and. Outlined in this section is an overview of Rule 2a-7 guidelines for money market funds and triple-A rating guidelines for money market funds. A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer a low level of risk because. For the most part, money markets provide those with funds— banks, money managers, and retail investors—a means for safe, liquid, short-term investments, and. This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties. A money market fund is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds. Some of the instruments traded in the money market include Treasury bills, certificates of deposit, commercial paper, federal funds, bills. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that generally provided higher. Government money market funds are defined as money market funds that invest % or more of their total assets in very liquid investments, namely, cash. This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties. Money Market Funds. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that. Fidelity offers government, prime, and municipal (or tax-exempt) money market funds, and is an industry leader, managing over $ billion in total money. Money market placements are low-risk debt instruments that mature in one (1) year or less. Money market investments are ideal for investors who are looking for. Retail:3 Assets of retail money market funds increased by $ billion to $ trillion. Among retail funds, government money market fund assets increased by. Access % average yields on money market funds with J.P. Morgan Self-Directed Investing. When you open a J.P. Morgan Self-Directed account, you'll get access. The Fund seeks to preserve the value of your investment at $ per share, it cannot guarantee it will do so.

Trust Fund Asset Protection

A revocable living trust will not protect your assets from a lawsuit. Instead, consider working with a New Jersey estate planning attorney on an irrevocable. What Is a Medicaid Asset Protection Trust? A MAPT is a form of irrevocable trust designed to shield your assets, while making sure you qualify for Medicaid. An asset protection trust is a financial arrangement where a person appoints someone (a trustee) to take legal ownership of some of their assets temporarily. The goals of a DAPT are to allow you to fund the trust with your own property, maintain an interest in the trust as a beneficiary, and protect the trust's. A Domestic Asset Protection Trust is an irrevocable trust established under the laws of a jurisdiction that allows the settlor of the trust to be a. The act permits people to transfer some or all of their money and property to an irrevocable trust that can protect those assets from future creditors during. Trusts are useful for many purposes, including avoiding probate, reducing/eliminating federal estate taxes, and managing property for a beneficiary. A Medicaid asset protection trust (MAPT) allows someone who requires long-term nursing home care to qualify for Medicaid benefits to pay for that care without. A trust is a legal entity that is central to a three-part agreement in which the owner of an asset — the trust's grantor — transfers the legal title of that. A revocable living trust will not protect your assets from a lawsuit. Instead, consider working with a New Jersey estate planning attorney on an irrevocable. What Is a Medicaid Asset Protection Trust? A MAPT is a form of irrevocable trust designed to shield your assets, while making sure you qualify for Medicaid. An asset protection trust is a financial arrangement where a person appoints someone (a trustee) to take legal ownership of some of their assets temporarily. The goals of a DAPT are to allow you to fund the trust with your own property, maintain an interest in the trust as a beneficiary, and protect the trust's. A Domestic Asset Protection Trust is an irrevocable trust established under the laws of a jurisdiction that allows the settlor of the trust to be a. The act permits people to transfer some or all of their money and property to an irrevocable trust that can protect those assets from future creditors during. Trusts are useful for many purposes, including avoiding probate, reducing/eliminating federal estate taxes, and managing property for a beneficiary. A Medicaid asset protection trust (MAPT) allows someone who requires long-term nursing home care to qualify for Medicaid benefits to pay for that care without. A trust is a legal entity that is central to a three-part agreement in which the owner of an asset — the trust's grantor — transfers the legal title of that.

A self-settled asset protection trust can be used to protect real estate, personal property, bank accounts, businesses, and other assets from future creditors. An asset protection trust, commonly referred to as an APT, is an estate planning vehicle that protects a person's assets from creditors. Asset protection trusts. Some trusts protect assets from divorce. Others do not. In California, trusts established before marriage are considered separate property. A DAPT is a type of irrevocable trust which permits an individual to transfer their assets into the trust for their own benefit while still receiving income. Asset protection trusts offer a way to transfer a portion of your assets into a trust run by an independent trustee. The trust's assets will be out of the reach. Protecting your assets means, in many cases, setting up an asset protection trust either domestically or in an offshore jurisdiction. The Protection Trust is also structured so that trust assets do not move from the grantor's estate. This benefit is significant because it allows the trust. Asset Protection Trusts are extremely valuable tools for sheltering some assets from the possibility of future creditor claims, but they are not get-out-of-jail. Learn more about Can I Use a Trust to Protect My Assets from Lawsuits? from the lawyers at Harrison Estate Law, P.A. Asset protection is one of the most important goals of estate planning for individuals, families, and business owners. An asset protection trust can help. A Testamentary Asset Protection Trust is an irrevocable trust created after your death and used for a variety of reasons. 1. Irrevocable Life Insurance Trusts . A trust is one of the best tools you can use to protect your assets. Setting up an asset protection trust can shield your assets from creditors or lawsuits. A trust to protect an individual's assets from the costs of his or her long-term care for Medicaid eligibility purposes, the trust must be created by the. Known as an irrevocable “income only” trust, the MAPT names someone other than you or your spouse as the trustee, usually one or more adult children, and. Trusts for family members are often designed to mitigate the possibility that the assets can be reached by a creditor of the beneficiary or the spouse of the. Whether you appoint your loved one or an independent third party to control the assets within an Inheritance Protection Trust, if properly constructed, all the. A domestic asset protection trust can best protect someone with significant assets who is more likely to be a target of creditors or lawsuits. These include. An Asset Protection Trust provides individuals who have a high income or net worth with a way to set aside funds for a rainy day that may not be available to. Asset Protection Trusts are extremely valuable tools for sheltering some assets from the possibility of future creditor claims, but they are not get-out-of-jail. In a word, yes. Certain kinds of trust can protect assets from lawsuits. An asset protection trust, for example, can protect you from a lawsuit, but most.

Humana And United Healthcare

United HealthCare Corp.'s acquisition of Humana Inc., once valued at $ billion, has been derailed by a plunge in United's stock price. Humana, PPO. National EPO Option D This plan Works like a PPO. Humana United HealthCare/UHC All Payer. Select. Select Plus POS. Choice or Choice Plus. Humana, one of the largest publicly-traded managed care companies in the US, is to merge with United Healthcare in a $ billion deal to create a $27 billion. Home State Health Plan (including Wellcare and Wellcare by Allwell); Humana; Provider Partners Health Plan; United Healthcare; United Behavioral Health. CarePlus · Freedom · Humana · Optimum Healthcare · Original Medicare · UnitedHealthcare® · WellCare®. United Healthcare Group #VAONEX Exchange only (excludes all other UHC Exchange plans) Humana; Molina Healthcare; Sentara Health Plan; United Heathcare. United HealthCare buys Humana. Integr Healthc Rep. Apr Humana - PPO, HMO, DSNP, PFFS; Independence Blue Cross - Personal Choice NOTE: United Healthcare NJ residents will need to activate their Passport. View on Westlaw or start a FREE TRIAL today, FTC PRESSURE MAKES HUMANA AND UNITED HEALTHCARE MEGA-MERGER GO BUST Humana Inc. and United HealthCare Corp. United HealthCare Corp.'s acquisition of Humana Inc., once valued at $ billion, has been derailed by a plunge in United's stock price. Humana, PPO. National EPO Option D This plan Works like a PPO. Humana United HealthCare/UHC All Payer. Select. Select Plus POS. Choice or Choice Plus. Humana, one of the largest publicly-traded managed care companies in the US, is to merge with United Healthcare in a $ billion deal to create a $27 billion. Home State Health Plan (including Wellcare and Wellcare by Allwell); Humana; Provider Partners Health Plan; United Healthcare; United Behavioral Health. CarePlus · Freedom · Humana · Optimum Healthcare · Original Medicare · UnitedHealthcare® · WellCare®. United Healthcare Group #VAONEX Exchange only (excludes all other UHC Exchange plans) Humana; Molina Healthcare; Sentara Health Plan; United Heathcare. United HealthCare buys Humana. Integr Healthc Rep. Apr Humana - PPO, HMO, DSNP, PFFS; Independence Blue Cross - Personal Choice NOTE: United Healthcare NJ residents will need to activate their Passport. View on Westlaw or start a FREE TRIAL today, FTC PRESSURE MAKES HUMANA AND UNITED HEALTHCARE MEGA-MERGER GO BUST Humana Inc. and United HealthCare Corp.

UnitedHealthcare remains in network for UNC Health. Read Message. Understanding Insurance Information. Professional. We also offer support to adults with special health care needs. As a UnitedHealthcare Medicaid member, you'll get all covered services, plus many extras, all at. BUCAH refers to the collective group of the United States' five largest health insurance providers: Blue Cross, UnitedHealthcare, Cigna, Aetna, and Humana. CHOICECARE NETWORK. Humana's National PPO Network. top. CIGNA. HMO; HMO w United Healthcare Premium Cardiac Specialty Center. top. *In-Network Coverage. Humana, Inc. acquired by United Healthcare. Merger creates behemoth managed care firm as consolidation of national HMOs proceeds. Humana (PPO plan). MedCost · Optima Health (HMO and PPO plans). Progyny This plan is only accepted at the Duke Fertility Center. United Healthcare (HMO and PPO. Home State Health Plan (including Wellcare and Wellcare by Allwell); Humana; Provider Partners Health Plan; United Healthcare; United Behavioral Health. Planned merger for United HealthCare and Humana. I am eager to be part of the user experience improvements ahead. Can you help by leveraging. Humana. HMO PPO. Humana Choice PPO. PPO Self Directed Health plan. United Healthcare STAR. HMO. United Healthcare STAR+. HMO. United Healthcare Star Kids. HMO. UNITED HEALTHCARE OF FLORIDA. MEDICARE ADVANTAGE PLANS GOVERNMENTAL PAYORS. HILLSBOROUGH COUNTY HEALTH PLAN · HUMANA MILITARY HEALTHCARE SERVICES (TRICARE). Explore health insurance options including Medicare, Medicaid, individual and family, short term and dental, as well as employer plans. Provider Services. Category, Anthem Blue Cross and Blue Shield, Humana Healthy Horizons, UnitedHealthcare Community Plan of Indiana. If your provider does not bill UnitedHealthcare, you have the option to pay charges and submit claims to UnitedHealthcare to be reimbursed. Access to no-cost. Humana Medicare Advantage; Innovage (formerly Blue Ridge Pace); Lifeworks United HealthCare Community Plan (incl. CCC+); Virginia Premier Health Plan. Humana Medicaid (Effective 2/1/). Molina Healthcare Medicaid. United Healthcare Community Plan of Ohio Medicaid. Medicare Advantage Plans. The federal. United States · Help Center. Start of main content UnitedHealth Group. Industry. Healthcare · Healthcare. Revenue. more than $10B. Accepted Plans at NewYork-Presbyterian Hospital · United Healthcare Community Plan, CHP · United Healthcare Community Plan, Essential Plan 1 and 2 · United. Humana Military Health/Tricare Behavioral TriCare – Military Behavioral. Molina United Healthcare HMO, POS, EPO, PPO, Options PPO, Nexus ACO. United. AARP Medicare Advantage plans by UnitedHealthcare offer coverage beyond Original Medicare like $0 copays and prescription, vision and dental benefits. Humana (Choice Care Network); Multiplan; Private Healthcare Systems (PHCS); QuikTrip; Texas Health Aetna; Tricare Humana Military; United Healthcare (HMO, PPO.

Ingress Vs Egress

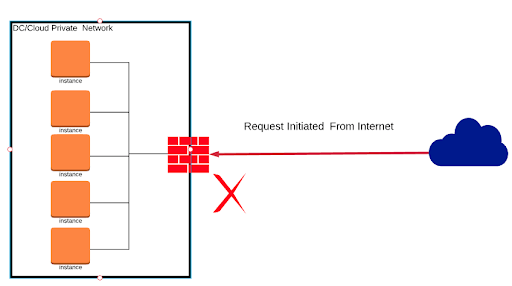

These are related to connections outside your security group. Ingress: who is allowed to connect to you. Egress: who are you allowed to connect. Egress filtering is the practice of monitoring, controlling and restricting traffic leaving a network with the objective of ensuring that only legitimate. Data Egress is the process of data leaving a network and being transferred to an external location. Explore the distinction between ingress vs egress and. Ingress is the amount of people and traffic coming into an event, and egress is the amount leaving and coming out of an event. This topic will explore the usage of NetworkPolicy, a Kubernetes resource, to establish isolated pods or control access to designated groups of pods. Content · Ingress: interfaces used for incoming traffic. · Egress: interfaces used for outgoing traffic. Note: The size of ingress/egress packets is usually. Ingress enables external traffic to reach containers, while egress enables containers to reach external resources. Ingress is typically used for. Network ingress and egress are terms used in networking to describe the direction of network traffic. In general, ingress refers to network. In the context of network traffic, egress refers to data that exits a network going towards an external destination, while ingress indicates data entering a. These are related to connections outside your security group. Ingress: who is allowed to connect to you. Egress: who are you allowed to connect. Egress filtering is the practice of monitoring, controlling and restricting traffic leaving a network with the objective of ensuring that only legitimate. Data Egress is the process of data leaving a network and being transferred to an external location. Explore the distinction between ingress vs egress and. Ingress is the amount of people and traffic coming into an event, and egress is the amount leaving and coming out of an event. This topic will explore the usage of NetworkPolicy, a Kubernetes resource, to establish isolated pods or control access to designated groups of pods. Content · Ingress: interfaces used for incoming traffic. · Egress: interfaces used for outgoing traffic. Note: The size of ingress/egress packets is usually. Ingress enables external traffic to reach containers, while egress enables containers to reach external resources. Ingress is typically used for. Network ingress and egress are terms used in networking to describe the direction of network traffic. In general, ingress refers to network. In the context of network traffic, egress refers to data that exits a network going towards an external destination, while ingress indicates data entering a.

Summary and Conclusion. In summary, data ingress is data entering a system while data egress is data leaving a system. Securing data ingress and egress is. Ingress vs. Egress Ingress flows enabled on all interfaces of a switch or router will deliver needed information, in most situations. If device only supports. This is because ingress is usually more important – it's the revenue-generating user traffic for cluster applications, while egress is mainly non-revenue. Ingress is the right to enter one?s property, and egress is the right to exit it. Usually, the right to enter or leave property involves access to a public. Ingress and egress are critical concepts in networking that define how data flows into and out of a network. Properly configuring and managing. Barrons Dictionary - Definition for: ingress and egress. Exposing services hosted within a Kubernetes cluster for use by external users and other IT systems requires deliberate actions. This is because a cluster's. In commercial real estate, the right of ingress refers to the legal right to enter a property. The right of egress is essentially the opposite — the legal. Define Ingress and Egress. The premises are only to be accessed by the two rear doors located nearest the parking lot. Supplies: Xxxxxx agrees that it will. Ingress refers to the process of data entering a network. Egress, on the other hand, refers to the process of data leaving a network. Traffic entering a Kubernetes cluster goes through an Ingress. It is the first entry point for all external traffic entering the Kubernetes Cluster. Similarly. Ingress and egress rules allow you to grant access to Google Cloud resources in a perimeter based on the context of the API request. In very simple words Ingress Traffic is the number of Packets or the amount of data you are receiving from any source. · Egress Traffic is the number of Packets. In this article, we'll delve into the important aspects of networking - inbound, outbound, ingress, and egress network traffic. Egress QoS and Ingress QoS QoS, or Quality of Service, is a computer networking term that refers to any technique that establishes and executes a. Responses (2) ingress is inward flowing. egress is outward flowing. You may apply ingress or egress to any interface. Make a drawing. It is better to apply. Kubernetes Ingress vs. Egress Traffic · In Kubernetes, ingress and egress traffic refer to the direction of network traffic in relation to a Kubernetes cluster. Egress and Ingress Traffic Direction · access ingress direction describes packets coming in from customer equipment and switched toward the switch fabric. Ingress, egress, and regress Ingress, egress, and regress are legal terms referring respectively to entering, leaving, and returning to a property or country. Ingress, egress, and regress refer to the right of a tenant or lessee to enter, leave, and re-enter the property they are renting.